VantageScore

Renter Credit Check Scoring Model

The VantageScore model allows you to make rental decisions with a higher level of confidence. Created by the three consumer credit bureaus (Experian, TransUnion, and Equifax), this model is a more advanced credit scoring solution. VantageScore is the only credit scoring model that factors in the current economy when evaluating data, allowing you to make more confident decisions when reviewing an applicant’s credit report.

With the VantageScore credit risk model, consumers who were previously unscoreable can be analyzed. VantageScore also outscores other credit scoring methods across all industries, so you know that you’re getting reliable credit scoring data.

VantageScore

Renter Credit Check Scoring Model

The VantageScore model allows you to make rental decisions with a higher level of confidence. Created by the three consumer credit bureaus (Experian, TransUnion, and Equifax), this model is a more advanced credit scoring solution. VantageScore is the only credit scoring model that factors in the current economy when evaluating data, allowing you to make more confident decisions when reviewing an applicant’s credit report.

With the VantageScore credit risk model, consumers who were previously unscoreable can be analyzed. VantageScore also outscores other credit scoring methods across all industries, so you know that you’re getting reliable credit scoring data.

What is VantageScore?

Developed in 2006 by Experian, TransUnion, and Equifax – VantageScore is an alternative to traditional scoring models, most commonly FICO. It has been re-evaluated and redesigned several times since being created in a continual effort to refine the score as a useful tool in making credit related decisions.

What is VantageScore?

Developed in 2006 by Experian, TransUnion, and Equifax – VantageScore is an alternative to traditional scoring models, most commonly FICO. It has been re-evaluated and redesigned several times since being created in a continual effort to refine the score as a useful tool in making credit related decisions.

How Does VantageScore Calculate Credit Risk?

VantageScore Comes with All the Benefits.

The VantageScore credit scoring model has been carefully created by the top three consumer credit bureaus in order to score more consumers. It’s estimated that more than 30 million more consumers have the ability to return a credit score than through comparable scoring models. You can rest assured you’re getting accurate data to help you make that important rental decision.

Click to Expand

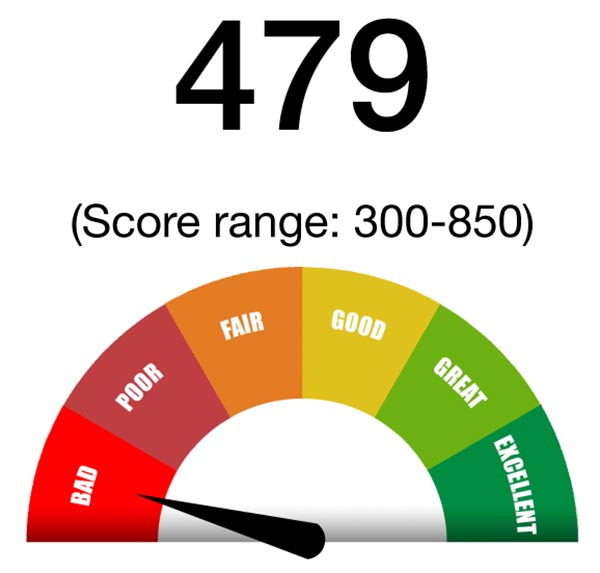

With a score ranging from 300 to 850, scores can be easily comprehended. ApplyConnect organizes that information into a user-friendly renter credit check, complete with visuals.

VantageScore 3.0 accounts for changes in consumer behavior to provide you with consistent information. It’s use of extensive, detailed data provides more predictive results. More accurate data is provided as post-recession data is analyzed.

VantageScore 3.0 was formulated to score consumers who were previously deemed unscorable by FICO standards. With its modern algorithm, VantageScore 3.0 allows for inclusivity as it has scored over 30 million previously unscoreable consumers.

VantageScore Comes with All the Benefits.

The VantageScore credit scoring model has been carefully created by the top three consumer credit bureaus in order to score more consumers. It’s estimated that more than 30 million more consumers have the ability to return a credit score than through comparable scoring models. You can rest assured you’re getting accurate data to help you make that important rental decision.

Click to Expand

With a score ranging from 300 to 850, scores can be easily comprehended. ApplyConnect organizes that information into a user-friendly renter credit check, complete with visuals.

VantageScore 3.0 accounts for changes in consumer behavior to provide you with consistent information. It’s use of extensive, detailed data provides more predictive results. More accurate data is provided as post-recession data is analyzed.

VantageScore 3.0 was formulated to score consumers who were previously deemed unscorable by FICO standards. With its modern algorithm, VantageScore 3.0 allows for inclusivity as it has scored over 30 million previously unscoreable consumers.

The Difference Between VantageScore and FICO.

Both VantageScore and FICO provide an easy-to-read credit score on millions of consumers using the credit scoring ranges of 300 – 850, but do you know the differences between the two? Find out why you should have VantageScore on all your tenant screening reports.

VantageScore

- Able to score over 30 million more consumers than FICO thanks to better credit file analysis of “thin” (minimal information) credit files

- Continually improved frequently and directly through the credit bureau’s data

- Not as immediately recognizable as FICO

- Developed by the 3 major credit bureaus

FICO

- Unable to read “thin” (minimal information) credit files

- Has different scoring models that can cause a credit score to vary by use

- Has been around for a long time and is a recognizable name brand

- Developed by the Fair Isaac Company

VantageScore

- Able to score over 30 million more consumers than FICO thanks to better credit file analysis of “thin” (minimal information) credit files

- Continually improved frequently and directly through the credit bureau’s data

- Not as immediately recognizable as FICO

- Developed by the 3 major credit bureaus

FICO

- Unable to read “thin” (minimal information) credit files

- Has different scoring models that can cause a credit score to vary by use

- Has been around for a long time and is a recognizable name brand

- Developed by the Fair Isaac Company

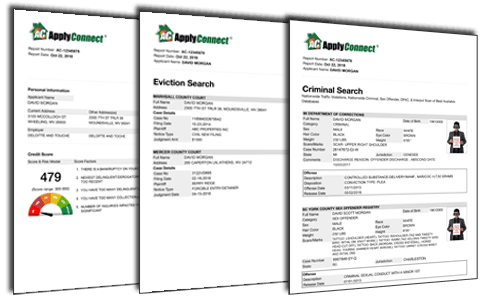

Complete Renter Credit Checks

Alongside our VantageScore credit score, all ApplyConnect reports come with a complete credit report directly from Experian, a nationwide criminal background check, and a nationwide eviction check. Each credit report includes a full payment history with all real estate, installment, and revolving credit accounts, civil judgements, tax liens and bankruptcy, prior names, addresses, and employment history.

Complete Renter Credit Checks

Alongside our VantageScore credit score, all ApplyConnect reports come with a complete credit report directly from Experian, a nationwide criminal background check, and a nationwide eviction check. Each credit report includes a full payment history with all real estate, installment, and revolving credit accounts, civil judgements, tax liens and bankruptcy, prior names, addresses, and employment history.

How ApplyConnect Works

Getting started with ApplyConnect tenant screening can be accomplished in just three steps!

How ApplyConnect Works

Getting started with ApplyConnect tenant screening can be accomplished in just three steps!

Simply complete a quick form and create an account! After filling out the short registration form and having your identity verified by Experian, you’re good to go. Not only is this process something that can be completed quickly, but it’s also free.

After creating an account the applicant will then purchase their own report (want to pay for the report? You can!), and give consent for it to be shared with you, creating a win-win scenario! Their credit score is unaffected because they shared it with you, and you have more money in your pockets. Win win!

View, Print, and Fill That Vacancy

ApplyConnect reports are processed within a matter of seconds after the applicant has paid. You’ll receive an email alert when the report is available, and can be viewed easily from your account dashboard. Now you have all the tenant information you need to make an informed decision.

Simply complete a quick form and create an account! After filling out the short registration form and having your identity verified by Experian, you’re good to go. Not only is this process something that can be completed quickly, but it’s also free.

After creating an account the applicant will then purchase their own report (want to pay for the report? You can!), and give consent for it to be shared with you, creating a win-win scenario! Their credit score is unaffected because they shared it with you, and you have more money in your pockets. Win win!

View, Print, and Fill That Vacancy

ApplyConnect reports are processed within a matter of seconds after the applicant has paid. You’ll receive an email alert when the report is available, and can be viewed easily from your account dashboard. Now you have all the tenant information you need to make an informed decision.

Learn More About the ApplyConnect Report

ApplyConnect’s goal is to be as transparent as possible. Know exactly what you’ll get when you choose ApplyConnect’s online tenant credit checks. Learn more about our tenant credit, tenant screening guidance, and background check reports.

Learn More About the ApplyConnect Report

ApplyConnect’s goal is to be as transparent as possible. Know exactly what you’ll get when you choose ApplyConnect’s online tenant credit checks. Learn more about our tenant credit and background check reports.