ApplyConnect has released a criminal, eviction, and credit score analysis for September through December, 2018. Highlighting the number of rental applicants that have criminal and eviction records on their tenant background checks, as well as the average FICO credit score, ApplyConnect’s quarterly data analysis shows that the applicants that are applying to your rental properties have promise.

Criminal and Eviction Records for Rental Applicants

September to December of 2018 yielded promising results for rental housing properties. This quarter showed that among all the tenant background checks processed, an average of 20.18% produced a criminal record. On the flip-side, this means that 79.82% of the rental applicants scanned did not have a criminal record in their background checks.

Quarterly, an average of 5.91% of all rental applicants possessed an eviction record, with an average of 8.7% producing an enhanced ‘eviction+’ record.

What’s the difference between a nationwide eviction scan and an enhanced eviction+ scan? Overall, the eviction record search looks for public record data on your rental applicant’s file within a proprietary database of 36+ million records built by ApplyConnect. This nationwide scan includes looking into past court actions, unlawful detainers, monetary judgments and court-ordered possessions. Eviction+ pairs ApplyConnect’s national eviction search with a more enhanced address history search.

Flip to See CIC's Criminal, Eviction, & Eviction+

Criminal Background Checks

Eviction Records

Eviction+ Records

FICO Credit Scores

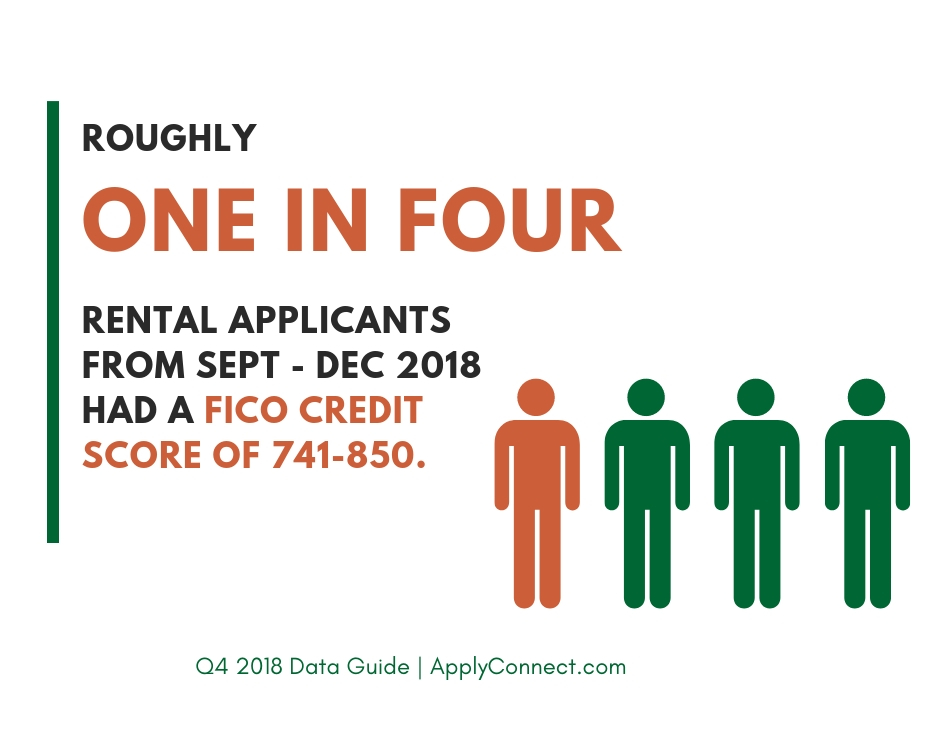

Alongside new rental housing criminal and eviction data, this quarter’s FICO credit scoring data revealed mixed results. For the good news – on average, 37.6% of all rental applicants scored this quarter had an excellent or good credit score, with FICO scores between 701 – 850. For the not-so-great news – an average of 34.55% of the applicants scored had a poor or very poor credit score, with FICO scores ranging between 300 – 640.

If your rental properties are encountering more low credit scores than high ones, it might be a good idea to add a policy targeting lower scores to your rental criteria that considers additional rental factors. These can be your property’s location, your rental competition, and even weighing the applicant’s criminal and eviction history.

As new rental applicant eviction, criminal and credit scoring background check data gets released, keep this in mind when you revise your property’s rental criteria. Click here to subscribe for future updates.

3 Replies to “Renter FICO, Criminal, and Eviction Trends 2018”

WOW!! This is great. I think there are many things I love the most. This post is definitely going to help for those who are facing problem.

I’m not a math whiz but the first paragraph numbers don’t seem to add up. Did I miss something? Or did you mean to say 70.82% of the 20.18% run?

Thank you for catching this Sandy! It was a typo that should have been 79.82% for the math to add up properly.