ApplyConnect has released the credit, criminal and eviction data for July through September 2019 and discovered that your tenant’s FICO scores trended downward. ApplyConnect’s quarterly data analysis highlights the number of rental applicants that have criminal and eviction records on their tenant background checks, as well as the average FICO credit score. Compared to the last quarter (April to June 2019), the average FICO score has declined slightly, which is likely due to Summer vacation spending and the increase of college student rental applicants.

FICO Scores Dip in Q3

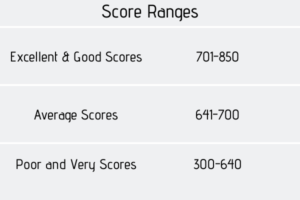

Since last quarter (April to June 2019), the ‘excellent’ and ‘good’ range has decreased by 2.57%, while the ‘poor’ and ‘very poor’ score range has increased by 2.27%. While there is a steady decline in credit scores month-over-month this quarter, on average, credit scores are still not as low as Q1 of 2019 was. On average, the total number of applicants in Q3 who had an ‘excellent’ or ‘good’ credit score amounted to 39.9%.

Reasons Why Credit Scores Are Dipping

While there isn’t enough data present to say for certain what is causing the dip, there are quite a few seasonal factors that could be causing the drop.

1. Summer Vacations

According to Business Insider, people spend an average of $1,979 annually on summer vacations – with both West and East coasters spending more on vacations than Midwesterners do. As this quarter was in the thick of Summer, its likely rental applicants used their credit cards to take care of their Summer vacation expenses.

2. New Renters Enter the Market

A big factor that could be contributing to the decline in FICO scores are the newest generation of renters. In our full credit score analysis, you can see that the rise in ‘poor’ and ‘very poor’ scores increase month-to-month. For ‘very poor’ scores alone, it goes from 13.1% in July to 15.2% in September! As most colleges start their Fall semester in September, it’s likely that rental applicants with student-debt, or first-time renters, might be aiding in the average FICO score decline.

3. Increase in Rental Applicants

These months were prime renting season, meaning a large number of renters were hunting for new rental unit to move in. Generally, the more rental applicants there are, the more likely you’ll see credit score diversity, which can have a big effect on the quarterly average.

As new rental applicant eviction, criminal and credit scoring background check data gets released, keep this in mind when you revise your property’s rental criteria.

One Reply to “Renter FICO Scores Have Dipped: This is Why it’s Not a Big Deal”

Hi, the whole thing is going perfectly here

and ofcourse every one is sharing data, that’s truly fine, keep up writing.