ApplyConnect has released credit, criminal and eviction data trends from 2019’s final quarter, October through December. The quarterly data analysis highlights the number of rental applicants that have criminal and eviction records on their tenant background checks, as well as the average FICO credit score. The analysis showed that, for the most part, many tenants had quite the holiday shopping trip.

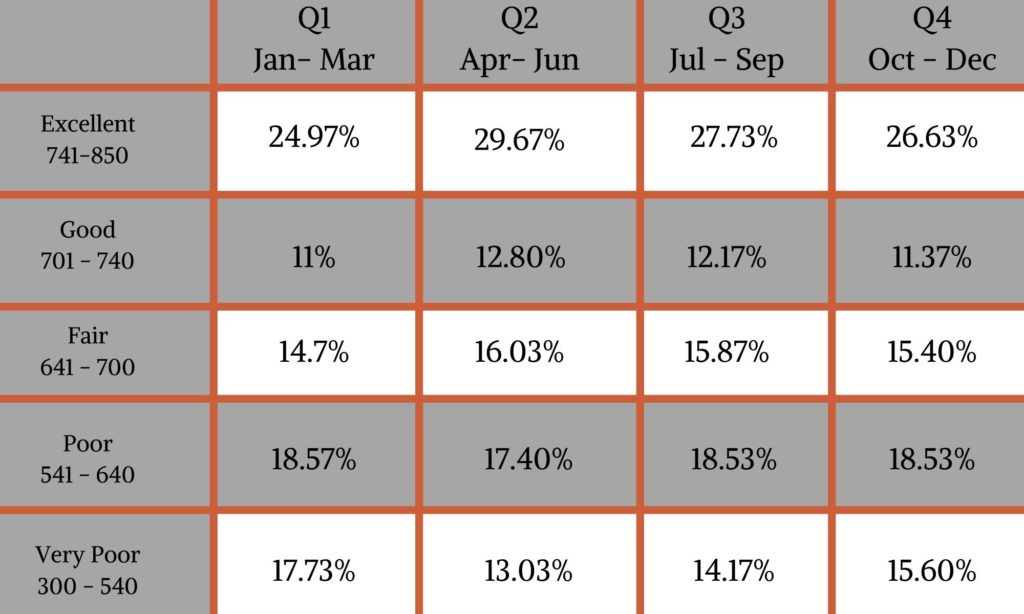

This year, the amount of those scoring in the excellent range and very poor switched places as the year progressed, each one having around a quarter of the population on opposite ends of the year. 2019 was a wild ride!

The Year as a Whole

Quarter 2 seems to be the best time of the year to rent out. That’s when the amount of people scoring excellent was at its highest point, almost at 30%. That number is quickly cut in half by Q3. Excellent was the largest percentile for both Q1 and Q2, but in Q3 and Q4, Very Poor had the largest number of people with the downturn of the holiday season, making the snowy part of the year the worst time to rent out a vacancy.

‘Unscorables’ per quarter ranged between 11-12%.’Unscorable’ applicants oftentimes have limited credit scoring data.

All About Last Quarter

Last quarter, over thirty-five percent of applicants had a good or excellent credit score. While this section of rental applicants (those with a score of 701-850) still represents the largest pool of applicants, the number has dropped to just over a quarter. The number of those with very poor scores (those with a score of 300-540) increased, but by less than a percentile.

There is no way to say with confidence why someone’s score dropped. A stranger can’t specifically state what happened to another person, but we can make plenty of educated guesses. Quarter 4 of the fiscal year is filled with massive holidays. Each holiday demands decorations. October demands an eerie vibe and lends itself to house parties, costumes, trips to haunted houses or fright fests. People go all out with creating a creepy vibe. November needs mostly new decorations, several grocery store trips, its own hotline, more house fires than one could want, the best sales of the year for major purchases, and trips to family members.

Both of these festive seasons all lead up to the Ultimate Festivity. Even though everyone just visited their family, they need to do it again, or use a new vacation as an excuse. The two weeks in winter that many schools have off give parents an excuse to splurge. And splurge they do, because December is the season of ‘giving.’ Many people use December holiday sales as an excuse to buy something that they wouldn’t during the rest of the year. Aside from ski trips to Aspen, they buy that TV being advertised as ‘lower than ever’ or new kitchen gadgets. Because December is the time of giving, they make large financial decisions or a series of small ones that lead to mounting credit debt.

It’s not all bad news. While many dropped out of their score

of Excellent and Very Good, their FICO rating will probably bounce back.

ApplyConnect has seen this before – as they pay off their holiday purchases,

many will find that their scores will return to what they normally are. It’s

important to keep that in mind as you review your property’s rental criteria

and potential renters. Right now may be a low period, but that’s is likely to

change.