Filling a rental property was a straight-forward process at one point in time (or so I’ve been told). Now maintaining even a small rental portfolio can be tremendously difficult – between the list of requirements and sometimes small margins that make focusing on maximizing profits especially important.

One way to maximize your potential while reducing the time needed is to develop a list of questions for your rental applicants. Developing a list of the most important questions to help qualify the applicants that have the most potential to move into the tenant screening and approval process will save you time and improve the odds of selecting more qualified renters. This can be a tricky proposition when you also consider the red tape surrounding the process so you don’t accidentally make a decision that could be construed as discriminatory. Whether you’re a landlord managing a property you own, or a real estate agent helping investment clients find qualified tenants, adding some of these questions to your pre-screening process can help save you and your applicants a lot of time.

Questions to Ask Potential Tenants:

Questions to Ask

Potential Tenants:

1. How did you hear about this property?

Unless you only work with one rental property and believe your new tenant will stick around forever, it’s a great idea to figure out what method works best for finding qualified renters. If you are a real estate agent filling rental properties then discovering the source of your leads should be second nature, and figuring out where a solid renter audience is will give you an edge filling rentals faster and increase your future buyer network.

If you are an owner or landlord of multiple rental properties then this information is even more crucial as you may not be networking exclusively with a crowd that lives and breathes the housing market on a regular basis. Regardless of what happens with this particular applicant you should first and foremost learn how they found you, and be mindful of any trends that can show you how to save time and money better marketing your rental properties.

2. Do you currently rent, and if so, where?

This is a great place to start when conducting a pre-screening interview with your potential renter. It can immediately let you know a bit about how to continue the conversation, and which questions might be more applicable than others.

For example, a former homeowner who is transitioning to renting might need some additional considerations when it comes to reviewing their credit report. They may have had to file a bankruptcy, or could be going through a divorce – neither of which may impact their quality as a renter, but might shed some insights into how to conduct the remainder of the interview. In the instance of a bankruptcy, their credit may show some damage, but their current situation might be perfectly trustworthy as your renter.

3. How long have you lived in your current home?

This is a good introductory question when speaking to a current renter, although its biggest impact might be foreshadowing for questions you plan to ask later on. Renters with a long-term rental history can make you feel more confident they are likely to stick around paying their rent and making your life easier. More importantly, a tenant who is leaving their current home after a short period of time might be breaking a lease, be forced to leave, or have any number of higher risk situations that could make them a liability for your property.

4. How long do you plan to live in this property?

Inquiring about whether your applicant has an estimated time they plan to live in the property is a good way to discover a little more about their situation that might give you confidence about them as a renter. Alternatively, this might enlighten you to whether there is some instability that could make more work for you sooner than later.

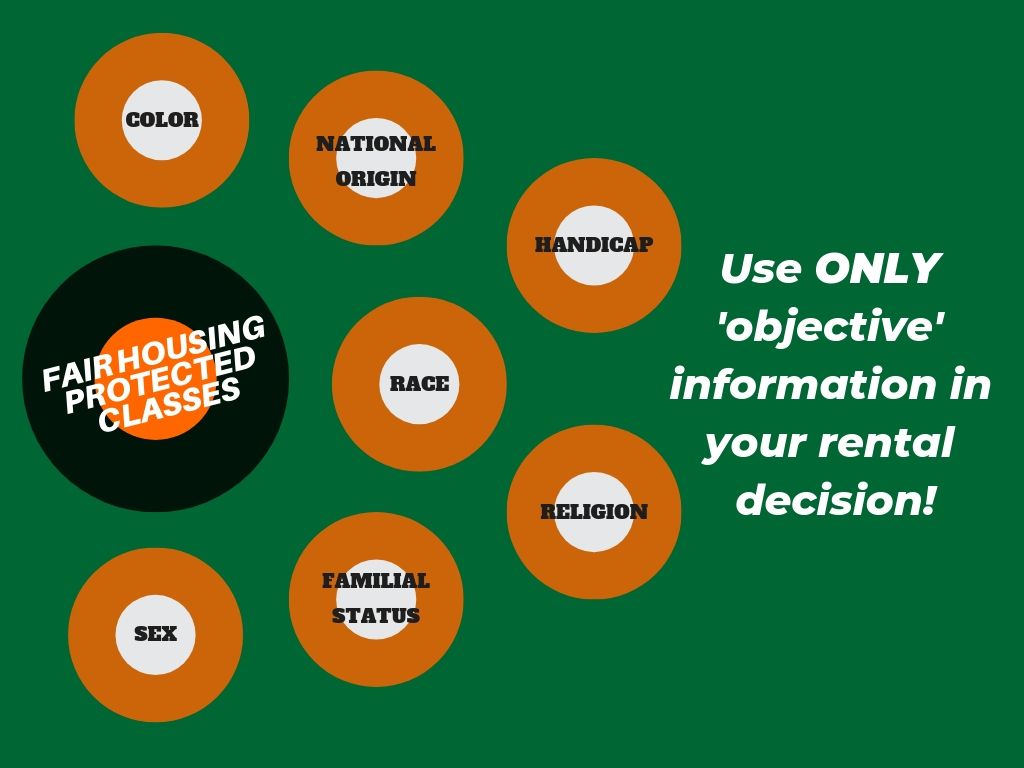

It’s important to treat this type of question as simply ‘discovery’. Your rental decisions should be heavily based on unbiased, objective data in order to best protect yourself from any denied and disgruntled applicants who feel they were discriminated against in some way. (see FHA Protected Classes)

5. Why are you moving?

As another type of ‘discovery’ question, this is a good opportunity to get the applicant talking a bit about themselves if they’re comfortable with it. It’s a simple way to attempt checking whether you may be in for some rough seas during their tenancy, or are more likely to have smooth sailing.

6. What date do you plan to move in?

A sense of urgency with an applicant who wants to move in ASAP should be just enough of a red flag that it encourages you to investigate a bit more. This might be accomplished verbally through your other discovery questions, or there could be some derogatory information found during the credit check or background check process.

Possible reasons for an urgent move:

- A domestic situation they are trying to get out of

- They are being kicked out by friends or family

- They are in the process of relocating

- They are being evicted

- They have procrastinated finding a new home after their lease expires

- They are headed towards financial hardship and need to cut housing costs

- Their current living conditions have become inhabitable

The point is there are plenty of reasons for an urgent move, and not all of them indicate a risky renter.

The flip side of a response you may get to this question could be an applicant who isn’t preparing to move for several months. Unless you happen to have a few months before the current renters vacate, chances are you aren’t in the market to hold onto a vacant property any longer than is needed. This could end your pre-screening process much more quickly, saving you both time.

A sense of urgency with an applicant who wants to move in ASAP should be just enough of a red flag that it encourages you to investigate a bit more. This might be accomplished verbally through your other discovery questions, or there could be some derogatory information found during the credit check or background check process.

Possible reasons for an urgent move:

- A domestic situation they are trying to get out of

- They are being kicked out by friends or family

- They are in the process of relocating

- They are being evicted

- They have procrastinated finding a new home after their lease expires

- They are headed towards financial hardship and need to cut housing costs

- Their current living conditions have become inhabitable

The point is there are plenty of reasons for an urgent move, and not all of them indicate a risky renter.

The flip side of a response you may get to this question could be an applicant who isn’t preparing to move for several months. Unless you happen to have a few months before the current renters vacate, chances are you aren’t in the market to hold onto a vacant property any longer than is needed. This could end your pre-screening process much more quickly, saving you both time.

7. Are you willing to sign a 1-year lease agreement?

This can be whatever term you want. Consider offering a slight discount to prospective tenants who will sign a 2-year lease agreement with terms that early termination will result in 3 times the rent. In the long run it might save you money by avoiding lost rent and marketing dollars.

8. Have you ever broken a lease?

Here might be a good time to bring up the cost of breaking your lease. If they have broken a prior lease then it will justify why you have the additional costs built in, and if they haven’t then they shouldn’t be concerned about it. This is also a good opportunity to add specificity to your list of questions for their previous landlord(s).

9. Are you familiar with our rental criteria?

At this point, you should have a basic feeling for whether this tenant will be a good match for your property in order to not waste either party’s time on a deal that won’t work. It’s also worth noting that up until this point have been a variety of good questions to ask, however, it’s worthwhile picking a handful that works best for you rather than feeling you should use them all every time.

In order to prove your decision process is as objective as possible, it’s important that you develop clearly written rental criteria. If nothing has completely disqualified the applicant up until this point then it’s a good time to provide a brief overview of what you consider an applicant worth approving.

Highlight important factors such as:

- The credit score (FICO or VantageScore 3.0) minimum you require, and possibly a range you will consider with an increased security deposit.

- What your policy on prior eviction judgments and filings is.

- Any specific types of criminal records that may disqualify them.

- The minimum income amount required to be considered.

- The credit score (FICO or VantageScore 3.0) minimum you require, and possibly a range you will consider with an increased security deposit.

- What your policy on prior eviction judgments and filings is.

- Any specific types of criminal records that may disqualify them.

- The minimum income amount required to be considered.

10. What kind of work do you do?

Gig work is a real living! If you live in an area with internet access, then it’s becoming more common that applicants might work a series of independent part-time jobs as opposed to a consistent paycheck from a traditional position. This is just a basic verification of whether they work, but changing the phrasing might actually open up the applicant pool.

Even with rephrasing this question to be more inclusive of qualified applicants it is still a best practice to require a bank statement if a reliable paystub is not an option.

11. What is a rough estimate of your monthly income?

This is a good follow-up to the previous question, as well as a nice introduction to the next. Verify that the applicant can afford the rent with a cushion in case things come up (they often do . . .). Pre-screening rental applicants ultimately boils down to answering two important questions: 1) can you trust your renters to maintain the condition of your rental property, and 2) will they consistently pay the agreed-upon rent each month and on-time.

12. How many people would be living in the household with you?

Here is your opportunity to essentially side-step asking a familial question that won’t violate the Fair Housing Act (FHA). Asking about an applicant’s familial status is prohibited as a potential method of discrimination, however, it’s well within your right to know who will be living in your property and how many of those are above 18 years old, justifying the need to have them on the lease.

A tenant’s familial status should have no bearing on your decision in approving or denying their application to be your renter. A house filled with roommates who all come from different rental backgrounds and financial situations is absolutely something you should be aware of. If you’re enlightened about a roommate situation then be clear that each individual on the lease will need to pass the application process as well.

13. How many people in the household smoke?

Unless you don’t mind your rental property having a distinct lingering odor of cigarette smoke, it might be worth your time to establish a ‘no smokers’ policy as part of your criteria. You can certainly build into your policy a disclaimer about no smoking allowed inside the structure, however, if you’ve ever had the displeasure of trying to fix up a rental with smoke saturated walls and carpets then it might be worthwhile to try and avoid the risk altogether. If an applicant confirms smokers in the house then having that be a disqualification from applying might be in your best interest.

You should also be prepared for an applicant to admit to smoking marijuana when asked this question as more states have made it medicinally and recreationally legal. Verify what your state’s laws are before establishing any type of criteria (consult with a legal expert as you should with any potential liabilities in your policy), and be prepared to make concessions for medical patients to avoid accidental discrimination due to disability. Marijuana can be imbibed through methods beyond smoking so you should still be okay retaining your ‘no smoking’ policy.

14. How many parking spaces would you require to accommodate everyone living in the household?

Depending on your rental property’s layout there might be a tight parking setup that can negatively impact neighbors if too many people have cars. It’s common enough that all individuals renting may have a vehicle, and your property may not accommodate 4+ vehicles without creating a disruption for the neighborhood. Phrasing this question in a way that prepares for a max number of available spaces to be permitted might also act as a disqualifier for some applicants.

15. How many indoor pets would be living in the property? How many outdoor pets?

Let’s get this out of the way right now – emotional support animals are still a complicated topic to cover. You can require a doctor’s note proving the pet is required, but sites are starting to appear that help renters obtain the necessary documentation online to circumvent the issue (note: I won’t link to one of these sites and help drive traffic to a potentially fraudulent business). Your best bet may be to establish the type of pet policy you feel most comfortable with for your property, and make concessions when an applicant who meets your criteria has documentation for an animal you wouldn’t otherwise accept. You won’t be able to charge an additional pet rent for the animal, but you are within your right to have an additional security deposit for the animal.

Moving past the complicated issue of emotional support animals in rental housing should leave a pretty cut and dry question for pre-screening your prospective rental applicants. People are attached to their pets so your policy with either fit their needs, or it won’t and you’ll both have to move on.

Let’s get this out of the way right now – emotional support animals are still a complicated topic to cover. You can require a doctor’s note proving the pet is required, but sites are starting to appear that help renters obtain the necessary documentation online to circumvent the issue (note: I won’t link to one of these sites and help drive traffic to a potentially fraudulent business). Your best bet may be to establish the type of pet policy you feel most comfortable with for your property, and make concessions when an applicant who meets your criteria has documentation for an animal you wouldn’t otherwise accept. You won’t be able to charge an additional pet rent for the animal, but you are within your right to have an additional security deposit for the animal.

Moving past the complicated issue of emotional support animals in rental housing should leave a pretty cut and dry question for pre-screening your prospective rental applicants. People are attached to their pets so your policy with either fit their needs, or it won’t and you’ll both have to move on. 16. Do you believe your current landlord will give you a favorable reference?

You’re a thorough professional so of course, you’re planning to check prior rental references, but it’s a nice time saver when the applicant will give you a heads up about what to expect when you call. This is a nice way to potentially get a feeling about what you might expect to hear from the applicant’s current or most recent landlord. Alternatively, if your applicant hesitates or stutters through answering this question you may want to consider it as a red flag.

17. Is your current landlord aware that you will be moving?

Future you will appreciate this question if one of your goals is to avoid the surprise of suddenly having a vacant rental to fill. There are plenty of good reasons that a renter might want to avoid informing their landlord of the impending move before their lease requires it, but for all of the not so good reasons out there this question might save you some headaches.

Following this question up by asking about whether their lease is ending on good terms can also be an enlightening way to determine what you might be in for when they eventually leave your property.

18. Is the lease ending on good terms?

Story time! If the answer to this isn’t a quick and confident ‘yes’, then you will want to press a bit harder for some details. If the applicant isn’t sharing anything else, or is trying to backpedal to sound more convincing, you should file this away as a question for their current landlord if you move forward with the rental application process.

19. Do you have any additional references you would be able to provide?

At the end of the day, this person is a stranger to you. Being able to talk to some personal references might add a bit of confidence to your decision to let this person live in your rental property.

20. Would you agree to a credit and background check?

This might be one of the most important questions you can ask during your pre-screening. You will still need to obtain a signed authorization in print or digital (somewhere you can store it for the next 6 years), but if an applicant won’t submit to a credit and background check then your conversation should end there.

You can also bypass the signed authorization portion of this process if you use a consumer-initiated tenant screening provider.

21. Have you placed a freeze or fraud alert on your credit?

This is becoming a more common question that should be asked prior to any request to view a consumer’s credit report, beyond just rental applicants. Following several years of high profile data breaches, including one of the three big credit bureaus – Equifax, consumers have begun taking additional steps to try and prevent fraud and identity theft. When a rental applicant has a freeze on their consumer credit profile you will not be able to receive a copy of their credit report unless the freeze is suspended or lifted.

If you are moving forward with requesting a credit report from your applicant then be sure they know to suspend the freeze with the bureau(s) you intend to receive their credit from. Having the applicant lift the freeze for a seven day period should be sufficient timing for you and any other potential properties they apply for to run their credit.

Direct your applicants to these resources to temporarily lift a credit freeze.

22. Do you have an idea of what your credit looks like?

If your rental applicant’s credit is a big factor in your decision then this is your opportunity to get an idea of whether they will qualify for your criteria. Simply being able to answer affirmatively to this question could be a good sign that they attempt to be responsible about their financials, and care about the status of the accounts reported. Alternatively, this might be related to any negative reasons that might have pushed them to place a credit freeze on their consumer profile.

23. Have you filed for bankruptcy within the past 7 years?

A bankruptcy on an applicant’s credit might be a major black cloud that prevents them from obtaining various types of credit, but it shouldn’t be an immediate red flag for renting property. Everyone needs a place to live, and bankruptcy might be the result of a multitude of reasonable causes that won’t have any impact on their ability to pay the rent on time. Moving to a rental property after filing for either chapter 7 or 13 bankruptcies can be common; however, it can wreak havoc on the applicant’s credit score.

Being aware of a prior bankruptcy can help you prepare for weighing the rest of your applicant’s credit and background check more heavily rather than relying too much on a high credit score. Being aware of this information can also help you determine whether you may be willing to permit a conditional approval based on either an increased security deposit or even a co-signer.

24. Have you been convicted of a crime that would violate our rental criteria?

On average, 20% of rental applicants have a criminal record that will appear as part of their background check. While you should be wary of applicants with criminal records, it’s also advisable that you should be more specific about the types of criminal transgressions that will violate your rental criteria.

For example, having a stipulation in your rental criteria against approving applicants with a prior felony on their record is too broad of a policy in most cases. What one state considers a felony, another might view as an infraction or not even a crime. A better policy is to specify the types of crimes that will result in an immediate denial should they appear in the background check.

Common types of offenses to avoid:

- Violent Felonies

- Sex Offenses

- Felony Property Damage

On average, 20% of rental applicants have a criminal record that will appear as part of their background check. While you should be wary of applicants with criminal records, it’s also advisable that you should be more specific about the types of criminal transgressions that will violate your rental criteria.

For example, having a stipulation in your rental criteria against approving applicants with a prior felony on their record is too broad of a policy in most cases. What one state considers a felony, another might view as an infraction or not even a crime. A better policy is to specify the types of crimes that will result in an immediate denial should they appear in the background check.

Common types of offenses to avoid:

- Violent Felonies

- Sex Offenses

- Felony Property Damage

25. How many eviction judgments and filings have you had within the last 7 years?

First and foremost this question should be tailored to work with your state’s laws. Oregon, as an example, only allows reporting of eviction records for the past 5 years while most other states permit 7 years of history to be reported.

Avoiding the potential of a ‘yes’ or ‘no’ response by phrasing this question as it’s shown can also improve the potential of getting a more honest answer. While an eviction filing is not proof of eviction, it does help provide objective proof that an applicant may not be as stable or reliable as they seem. A history of eviction filings is a good indicator that the applicant has been a troublesome tenant to previous landlords.

This is also a good time to mention that credit reports do not include eviction records. In the past, the credit report may have included some public records if they were related to a monetary judgment from an eviction, however that changed in 2017 with the introduction of the National Consumer Assistance Plan (NCAP). Most civil judgment data and more than half of tax lien data have now been removed from credit reports to comply with the bureau’s heightened requirements for improving data accuracy.

26. Is there any additional information that may appear on a credit and background check that I should be aware of?

The more you can get your applicant talking, the more information you might be able to obtain without even trying. Asking open-ended questions like these may not lead to much conversation, but they may also divulge interesting information you hadn’t thought to ask about.

With regards to your rental applicant’s credit and background check a common response might be about medical debt. This would provide you with an opportunity to inform the applicant that medical debt is factored into credit reports differently. Experian actually doesn’t provide past due medical tradelines unless the account is more than 180 days past due, or has been sent off to a collection agency, in which case it would show up as a collection account.

27. Will you be fine to pay the lease application fee of ($XX.xx) per person applying for this property?

There is no such thing a joint credit reports on rental applicants, and that’s certainly not an option for criminal and eviction background checks. The only exception is if they are under the age of 18. Verify what your tenant screening costs will be, and add any additional application fees you might find reasonable. When establishing your application fee be sure to check whether your state or region has any caps on the max that can be charged for this process.

28. Do you have an active checking and/or savings account?

This is one of the more invasive and seemingly unnecessary questions on this list but hear us out. This is a great recommendation from BiggerPocket’s list of rental questions, and it’s worth considering for your options to pre-screen rental applicants.

As Brandon Turner from BiggerPockets puts it, “having a bank account does not magically make your prospective tenant more responsible; however, not having a bank account is a definite sign that something might be amiss.” This question shouldn’t be a make or break for your applicant’s potential at being approved, but it should be something you’re aware of when determining their qualification for your property.

As a good follow up to this question, supposing they answer in the affirmative to having one or both accounts, you can inquire about the approximate balance in the account(s). This can be an off-putting question to your applicant, but your job here is to determine whether this individual can (and will) be financially secure and responsible enough to ensure you get paid every month. Having little to no financial security blanket in their account(s) should factor into your determination of how risky this applicant might be when it comes to ‘that time of the month.’

29. Will you be able to pay all move-in costs upon the lease signing, including first and last month’s rent, as well as a security deposit, if required?

Unlike whether your applicant has any bank accounts, this question actually should be one of your make or break questions before moving ahead. This one should also be right in your wheelhouse. Renting out a property is a business, and businesses run on money. If the applicant can’t pay what you are asking, and you aren’t willing to make concessions that work better for them, then it’s time to part ways.

30. Do you have any additional information you would like to provide that can be helpful in making my decision?

Another open-ended question that might help this process go smoothly and make you feel more confident about whatever decision you make. This question might end up leading to the tiebreaker if you have multiple applicants that qualify for the same property.

31. Do you have any questions for me?

As with any good interview, you should offer the opportunity for your applicant to learn more about you and what they are applying for.

By incorporating a mixture of these questions that best support your rental criteria you are sure to improve the odds of speeding along the application process. The result is more reliable tenants, happier investment clients, less stress managing a rental property, or even happier applicants who don’t spend money on an application fee for a property they won’t be approved for.

For the applicants that do meet with your qualifications enough to warrant a credit report and background check, try ApplyConnect – a no-cost solution to tenant screening. Your free account provides you with access to marketing resources that help promote properties, useful legal tools to protect you and your assets, and the ability for applicants to share their complete nationwide credit and background check.

Ready for a tenant credit check on your applicants?

Did you like this article? If so, share it with other rental pros who will find it useful!

Have any questions that didn’t make this list, or you want feedback on?

Leave a comment below!

2 Replies to “31 Excellent Questions You Need to Qualify Renters”

If you own an investment property that you’re looking to rent out to tenants, the services of a property management company can come in handy.

Knowing what questions a landlord might ask is super helpful. My partner’s parents are looking for a new home to rent because their current house is too big. Knowing what kind of questions and things to prepare for will be a huge help in looking for the right property.